November 14, 2025

Third Quarter 2025 Highlights

- XBP Europe Holdings, Inc. (“XBP Europe”) finalized the acquisition of Exela Technologies BPA, LLC (“Exela BPA”) and changed its name to XBP Global Holdings, Inc. on July 29, 2025

- XBP Europe issued approximately 81.8 million shares for an equity valuation of the combined company of $585.7 million, or $4.98/share

- Reported revenue1 totaled $209.1 million, a decline of 10.4% year-over-year

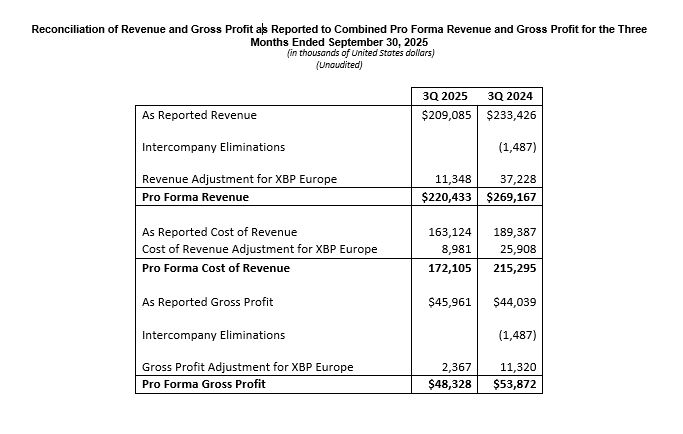

- Combined Pro Forma Revenue2 totaled $220.4 million, a decline of 18.1% year-over-year

- Gross margin on a reported basis was 22.0%, a 310 basis point increase year-over-year

- Pro Forma Gross Margin2 of 21.9%, a 190 basis point increase year-over-year

- Pro Forma Adjusted EBITDA2,3 of $24.7 million, an increase of 7.4% year-over-year

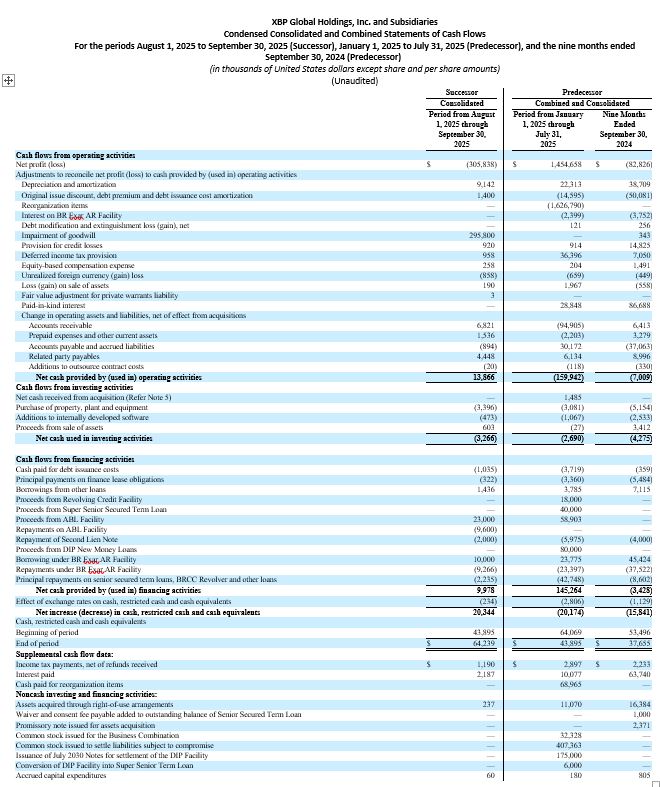

IRVING, TX, November 14, 2025 (GLOBE NEWSWIRE) – XBP Global Holdings, Inc. (“XBP Global” or “the Company”) (NASDAQ: XBP), a workflow automation leader leveraging decades of industry experience, a global footprint, and agentic AI to rethink business process automation and digital transformation, today announced its financial results for the quarter ended September 30, 2025. Due to the partial quarter of combined operations as a result of the mid-period acquisition, the Company has provided combined pro forma results and metrics, in addition to as reported results, along with reconciliations to the most comparable GAAP metrics in this release. Reported results exclude XBP Europe until July 29, 2025 and treat Exela BPA as the accounting acquirer. Thus, reported results are not comparable to previous earnings results of XBP Europe.

“Following the transformative business combination with Exela BPA, we are thrilled to advance XBP Global to the next level. With our global scale, sustainable capital structure, enhanced corporate governance, and mission-critical workflow automation solutions powered by expanded agentic AI capabilities, we are thoroughly excited for the future of the company. We are actively positioning our organization for growth, with multiple initiatives involving client outreach, investment in new talent, and preparations for more active interactions with the investor community,” said Andrej Jonovic, Chief Executive Officer of XBP Global.

Third Quarter Highlights

As Reported Basis

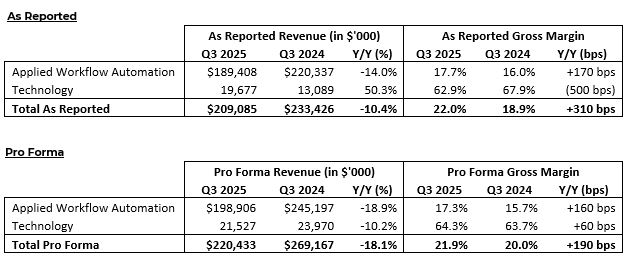

- Revenue: Revenue was $209.1 million, a decrease of 10.4% year-over-year

- Gross Margin: Gross margin was 22.0%, an increase of 310 basis points year-over-year

Pro Forma Basis

- Revenue: Combined Pro Forma Revenue was $220.4 million, a decrease of 18.1% year-over-year

- Gross Margin: Pro Forma Gross Margin was 21.9%, a 190 basis point increase year-over-year

- Pro Forma Adjusted EBITDA: Pro Forma Adjusted EBITDA was $24.7 million, an increase of 7.4% year-over-year. Adjusted EBITDA Margin was 11.2%, an increase of 260 basis points year-over-year

Segment Results

Below are the notes referenced above:

- Reported results exclude XBP Europe until July 29, 2025 and treat Exela BPA as the accounting acquirer. Thus, reported results are not comparable to previous earnings results of XBP Europe.

- Financial results are presented on an unaudited pro forma basis, as if the acquisition of Exela BPA had been consummated on January 1, 2024.

- Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP measures. A reconciliation of non-GAAP measures is attached to this release.

Earnings Call and Supplemental Investor Presentation

The Company will host a live conference call at 4:30 pm Eastern Time today, accompanied by a live webcast. Hosting the call will be Andrej Jonovic, Chief Executive Officer, and Dejan Avramovic, Chief Financial Officer.

Participant Call-In Registration: Participants who wish to join the conference by telephone must register using the following dial-in registration link to receive the dial-in number and a personalized PIN code that will be required to access the call: https://register-conf.media-server.com/register/BIc5fa5cf3ce2148b98b504e4852d0b395.

Participant Live Webcast Registration: To access the live webcast, please visit https://edge.media-server.com/mmc/p/ups2x4e9 or XBP Global’s Investor Relations website at https://investors.xbpglobal.com/.

Rebroadcast: Following the live webcast, a replay will be available on the XBP Global Investor Relations website.

An investor presentation relating to our third quarter 2025 performance is available at https://investors.xbpglobal.com. This information has also been furnished to the SEC in a current report on Form 8-K.

About Non-GAAP Financial Measures

This press release includes certain pro forma financial information, which is presented for informational purposes only and is not prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). Pro forma results are presented on an unaudited basis as if the acquisition of Exela BPA had been consummated on January 1, 2024, regardless of the actual closing date.

For financial reporting purposes, Exela BPA is treated as the accounting acquirer, and results exclude XBP Europe until July 29, 2025. As a result, reported results for periods prior to July 29, 2025 are not comparable to previous earnings results of XBP Europe.

Pro forma financial information is intended to provide investors with a clearer understanding of the underlying performance and trends of the combined business by illustrating the impact of the acquisition on historical results. These results are designed to facilitate period-to-period comparisons and enhance transparency into ongoing operations.

Pro forma information is based on certain assumptions and adjustments, including the elimination of intercompany transactions, acquisition-related costs, and the alignment of accounting policies, as described in the accompanying tables and footnotes. This information is unaudited and does not purport to represent what actual results would have been had the acquisition occurred at the dates indicated, nor does it project future results.

Pro forma financial information should be read in conjunction with historical financial statements, related notes, and the pro forma adjustments and explanatory notes included in this release.

About Non-GAAP Financial Measures

This press release also includes certain non-GAAP financial measures, including EBITDA, Adjusted EBITDA, and Adjusted EBITDA margin, which are not prepared in accordance with GAAP.

These measures provide investors with additional insight into financial performance, results of operations, and liquidity, and help facilitate comparisons of underlying business trends across periods. Management uses these measures to evaluate performance consistently by excluding the effects of capital structure (such as varying debt levels, interest expense, and transaction costs from acquisitions).

Adjusted EBITDA also excludes integration and restructuring expenses and other non-routine items, some of which are outside management’s control. Restructuring expenses are primarily related to strategic actions and initiatives associated with rightsizing the business. These costs are variable, dependent on the nature and timing of the actions implemented, and can vary significantly based on business needs. Due to this variability, management excludes these charges as they do not believe such costs reflect past, current, or future operating performance.

Non-GAAP financial measures should not be considered in isolation or as alternatives to liquidity or financial measures determined in accordance with GAAP. A limitation of these measures is that they exclude significant expenses and income required by GAAP to be recorded in the financial statements. In addition, the determination of which items to exclude or include involves management judgment, and these measures may not be comparable to similarly titled measures reported by other companies.

These measures are not required to be uniformly applied, are unaudited, and should not be considered in isolation or as substitutes for results prepared in accordance with GAAP, and their presentation may not be comparable to similar measures used by other companies. Net loss is the GAAP measure most directly comparable to the non-GAAP measures presented here. For a reconciliation of the comparable GAAP measures to these non-GAAP financial measures, see the schedules attached to this release.

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. These statements include financial forecasts, projections, and other statements about future operations, financial position, business strategy, market opportunities, and trends. Forward-looking statements can often be identified by terms such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “plan,” “targets,” “projects,” “could,” “would,” “continue,” “forecast,” or similar expressions. All forward-looking statements are based on estimates, forecasts, and assumptions that are inherently uncertain and subject to risks and factors that could cause actual results to differ materially. These include, but are not limited to: (1) risks related to the acquisition, including the inability to realize anticipated benefits, disruptions to operations, and costs associated with the acquisition; (2) legal proceedings; (3) failure to regain or maintain compliance with Nasdaq listing standards; (4) competition and market conditions; (5) economic, geopolitical, and regulatory changes; (6) challenges in retaining clients, employees, and suppliers; and (7) other risks detailed in the Company’s filings with the SEC, including the “Risk Factors” section of its Annual Report on Form 10-K for 2025, filed on March 19, 2025, and the proxy statement for the 2025 annual meeting. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date made. XBP Global undertakes no obligation to update these statements, except as required by law. There is no assurance that XBP Global or its subsidiaries will achieve the results projected in these statements.

About XBP Global

XBP Global is a multinational technology and services company powering intelligent workflows for organizations worldwide. With a presence in 20 countries and approximately 11,000 employees worldwide, XBP Global partners with over 2,500 clients, including many of the Fortune 100, to orchestrate mission-critical systems that enable hyper-automation.

Our proprietary platforms, agentic AI-driven automation, and deep domain expertise across industries and the public and private sectors enable our clients to entrust us with their most impactful digital transformations and workflows. By combining innovation with execution excellence, XBP Global helps organizations reimagine how they work, transact, and unlock value.

For more news, commentary, and industry perspectives, visit: https://www.xbpglobal.com/

And please follow us on social:

LinkedIn: https://www.linkedin.com/company/xbpglobal/

The information posted on XBP Global’s website and/or via its social media accounts may be deemed material to investors. Accordingly, investors, media and others interested in XBP Global should monitor XBP Global’s website and its social media accounts in addition to XBP Global’s press releases, SEC filings and public conference calls and webcasts.

Investor Relations: David Shamis, investors@xbpglobal.com | Media Queries: Srushti Rao, press@xbpglobal.com